A lot goes into starting a credit repair business and while it feels exciting it can be a tad challenging as well. The first thing you need to do is to comply with your local and national laws, rules, and regulations as well as look for the proper software, documentation, and licensing aspects so that you can carry on without a hitch. Most clients find that reliable and trusted software like a Client Dispute Manager software can not only make the entire process easier but allow them to run a credit repair business right from the comfort of their homes or offices.

If you’re thinking of starting a Credit Repair Business the first thing you need to keep into account is preparing your contract for the same. Usually, a contract can take a lot of time and effort to prepare, however with MC-Credit Solutions you can simply build your contract and upload it seamlessly and efficiently without any hassle. Here are some tips to keep in mind to not only start your credit repair business but run it successfully.

Prepare the right tools for the job

Whether you’re a businessman, entrepreneur, or even a homeowner and are looking to start your credit business, the first step you need to take is to prepare your contract. While this process can be tricky, it’s always better to opt for a Client Dispute Manager software that’s designed by professionals and have its own experienced and trained staff to take you through the entire process. These experts will show you which website to go on and what to click on to find your digital contract section, once this is done you can then choose between different types of contracts from a starter contract to a long-term contract that contains all the basic guidelines and clauses you require to get started.

Unlike other companies, MC-Credit Solutions will also allow you to tailor this contract to meet your requirements and once this is done, you can send this contract to your attorney to re-check it and ensure that all your paperwork is in order before you go ahead. While you can do it yourself, it’s always better to have a professional by your side to help you so that you can successfully run your credit repair business.

Create some ground rules

Once your contract is done successfully, it’s time to make a plan and create your client auto signup form. This part of your Credit Repair Business Plan allows your clients to have access to all your credit services so that they can signup anytime they require, all they need to do is log on to your website and just sign up for your credit repair services at any time, from any device and any location. This makes it easy for you and all you need to focus on is keeping your website up and running at all times so that your customers can sign in and apply whenever required.

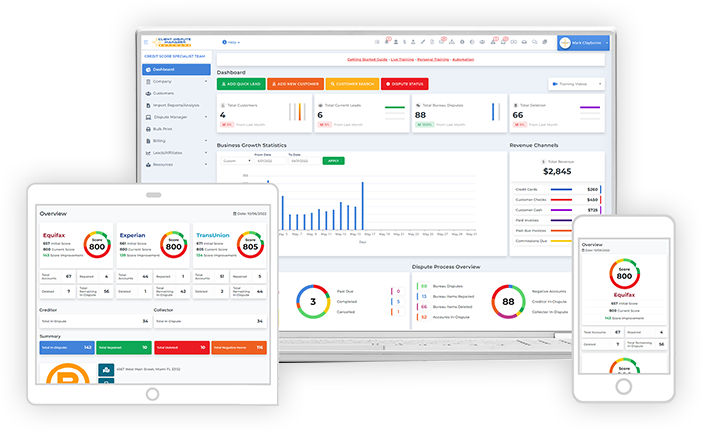

Now when it comes to setting up your system, always invest in high-end software like Client Dispute Manager as these professionals are well-versed in what they do and have worked with clients from a range of industries. They can help you build your form and set up your system in such a way that it drives customers to your website and makes it simple for them to sign up and see all that you have to offer. Once they sign up for your services, they can go through the entire onboarding process step-by-step making it easier for them to avail of your credit repair services. Since your services are available online 24/7, it allows clients to even sign in while traveling or on the go.

Setting up your credit analysis

So, you’ve picked the perfect Credit Repair Business Software and this has helped you to analyze your customer’s credit report, pick out all the inaccurate information and errors as well as determine their credit score and how you can help them as well as the next steps to take. Once this is done, you can simply use your software to email all this data to your customers.

A Client Dispute Manager software makes this process simple for you as all you need to do is pick your customer, run an analysis and the data will be provided to you after careful monitoring, once this is done simply send it across to your customer. Most small and medium-sized companies prefer having a professional to help them run a successful credit business or even outsource it to the experts. This allows you to focus on other important things in your company as well as your employees.

Determining the issues

Once you’ve got the summary of the credit report you still need to go through all the errors and inaccurate information as well as find all the issues with the report. MC-Credit Solutions software can help you out with this and it will analyze the report step by step and mark out all the errors as well as show you where the problems lie. This, in turn, can help you determine the root cause of the issues and send the same across to your clients so that they can click on it and check the report themselves as well as the solutions you can undertake to help them get their credit report clean again.

Stay active and take action

Now that you’ve availed of the Credit Repair Business Training and analyzed the reports as well as determined the issues present you need to interview your customer and find out how these issues were caused as well as what steps they are taking wrong and the solutions you can use to help them get back on track. Once a customer head to your site and signs up for your credit repair services you need to then interview them either manually through a video call on their phone or even a zoom call on their laptop to find out what’s wrong with their credit report.

While calls are great, it’s always good to have the customer in front of you when it comes to determining these issues as it helps make the process much easier. It also allows you to go through the credit report step by step and target each problem you come across and get in-depth into the issue so that you can solve it easily and dispute it in front of a credit bureau. MC-Credit solutions Client Dispute Manager software makes this effortless for you – once your customer logs into the tracking portal they can simply click on smart interview and start the process by themselves. This process is completely automated and will do all your work for you to review later, all you need to do is send the link across to your client and they can take this interview whenever they are free.

Once the interview process is completed and you have all the data with you, you can then easily dispute the errors to the credit bureau or even send them a letter explaining the same.

In Conclusion

While it may seem like a lot for a first-time business owner and you may feel the pressure to handle every task that comes your way, you don’t have to. The Client Dispute Manager software makes it easier for you to run a credit repair business and is jam-packed with all the tools you need so that it’s quick, seamless, and efficient for both you and your customers. You can even avail a free trial and determine if this software is right for you. Investing in reliable and professional software can help cut out half your work for you so that you can focus on other important aspects of your business and easily sign on clients from the comfort of your home without any experience at all – it’s that easy!